With UK COVID lockdown restrictions easing and more cars back on the road, many people will be driving their cars for the first time in months. Vehicle neglect and lack of servicing means that the chances for breakdowns will increase. We look at setting up a mobile service and the breakdown and recovery insurance safeguards you will need to protect you and your customers.

Millions of journeys are made every day on the country’s busiest roads – motorways and major A-roads – and most are incident-free. But around 600 journeys a day involve a breakdown. In 2019 there were almost 230,000 reported breakdowns across the Highways England network including around 207,500 on motorways. In the 12 months from June 2019, around 40,000 breakdowns were recorded as being due to tyre issues while more than 6,000 incidents were as a result of vehicles running out of fuel.

In a recent Twitter poll by Highways England, more than 84 per cent of respondents said that they last checked their vehicle between one to three months ago.

As the figures stand it is a great time to think about setting up a vehicle breakdown and recovery service, but you do need to be aware about the myriad of rules and regulations affecting this business and the insurance implications to stay protected.

How to Get Started

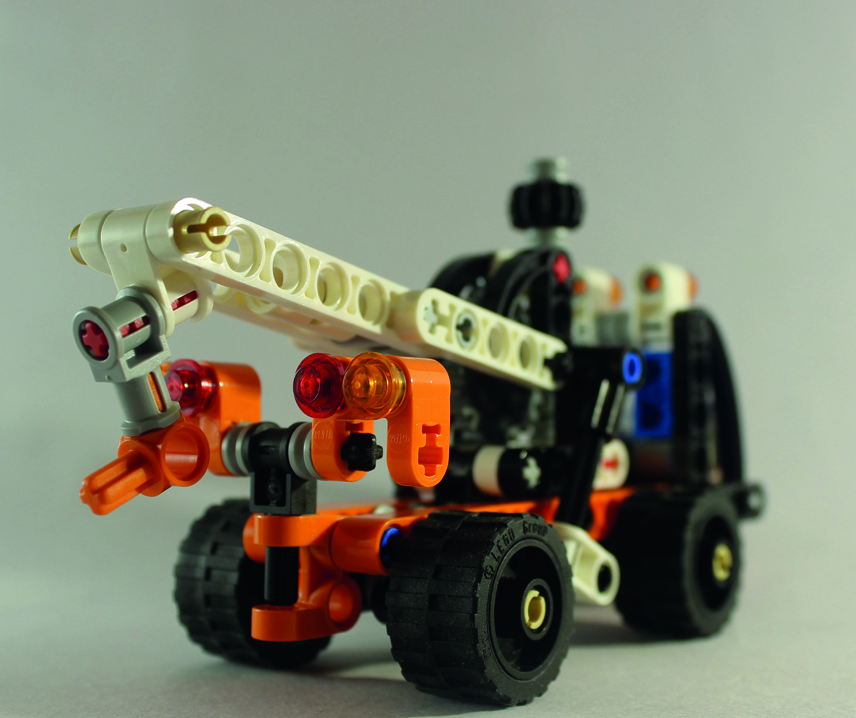

It is not just a case of purchasing a tow truck and advertising your services. Before you even begin you need to check out the rules and regulations affecting this sector. One essential place to start is here:

https://www.gov.uk/government/publications/guide-for-recovery-operations/running-a-vehicle-recovery-business-driver-and-vehicle-safety-rules

This is the official UK government documentation that you must study in order to follow the correct criteria for setting up a recovery business.

It describes in detail what you can and cannot do as a recovery business and how road tax can be affected by the weight of your recovery vehicle. For example, trucks with a gross weight of between 3,500kg (or 3.5 tonnes) and 25,000kg (or 25 tonnes) can benefit from an annual rate of excise which is equivalent to the basic goods vehicle rate. Vehicles in excess of 25,000kg goods-vehicle weight attract an annual rate of duty equivalent to two and a half times the basic goods vehicle rate.

Getting the Right Breakdown and Recovery Insurance

As well as a tow truck, you will need all the correct equipment including cones, floodlights, tow ropes and a selection of tools. You’re also going to need a secure garage in which to keep your vehicle and equipment.

As a vehicle breakdown and recovery operator, you will need to consider not just road risk insurance for your own vehicles, but also insuring the vehicles you are working on, towing or transporting on the back of your truck. You may need insurance to cover employees and might want to consider public liability insurance in case of a claim from a member of the public against any damages you may have caused to themselves or their property.

When looking for the right insurer, they should be able to cover you whether as a small individual breakdown freelancer, a garage or even fleet operator. A good broker will find a motor trade insurance policy that can be tailored to your individual needs and restructured as your business expands.

Aside from breakdown and recovery, other insurance options include storage, premises cover (including stock, fixtures and fittings, tools and mobile equipment), movement of own and customers’ vehicles, sale of vehicles and much else besides. Try and obtain as much comprehensive insurance cover to guard against all eventualities for you, your business and your customers.